If private placement investing in cannabis is appealing, or as an investor you need another reason to look at 2020 as the year to step into the blossoming legal cannabis market, look simply to the midwest.

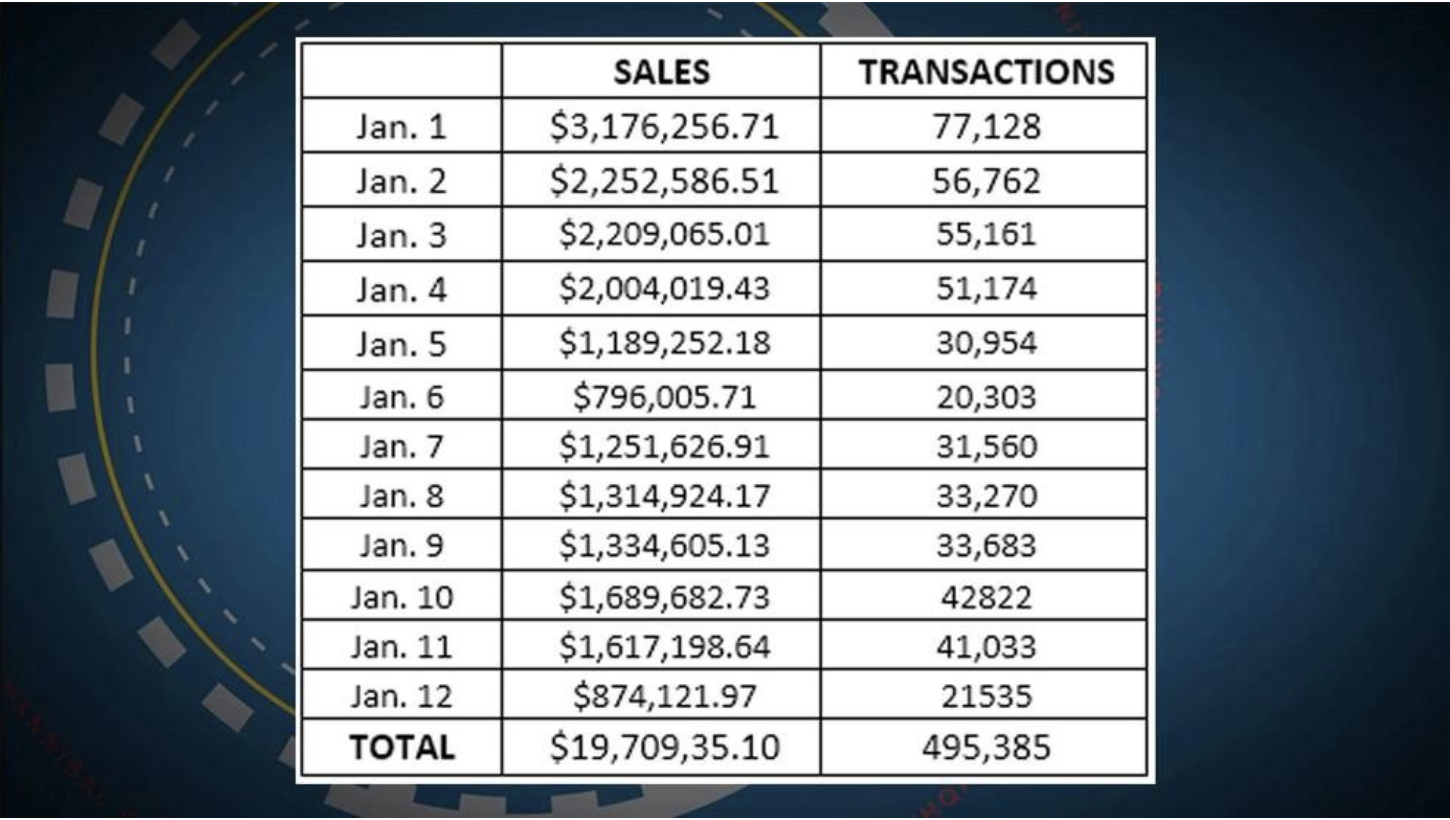

Because in short time after the state of Illinois legalized adult-use cannabis sales, shops sold more than $19.7 million in recreational weed the first 12 days of sales alone, through more than 495,000 purchases during that time.

The first day of sales was one of the strongest in the history of legal weed no matter how you slice it, but it’s also worth noting that unlike Massachusetts – which has seen a slow slog rollout of retail storefronts amid the regulatory snafus that continue to be refined and reworked – the state opened its market with almost as many shops on the first day of legal sales as the Bay State has four years after passing legal adult-use sales locally.

Which is another way of saying with more access comes more sales, and ultimately, more ROI on local and national cannabis investments in the long run for private placement investing in legal marijuana market.

From The Chicago Tribune:

“Illinois’ first week of recreational sales, which saw nearly $12.9 million in purchases, topped some other states. Oregon sold $11 million worth of legal weed in the first week, said Bethany Gomez, managing director of cannabis research firm Brightfield Group. Colorado stores did $5 million their first week.

‘$19 million in less than two weeks is really strong, especially given all the challenges that Illinois faces in terms of supply shortages,’ Gomez said. ‘It is a really strong indication that the market is going to be very, very healthy here.'”

Illinois ABC affiliate KHQA has also been covering the successful rollout of adult-use sales from the numbers side of things as well, and quoted Toi Hutchinson, Senior Advisor to Illinois Governor Pritzker for Cannabis Control:

“Illinois had a far more successful launch of cannabis than many of the other states that have legalized, but this is about more than money, it’s about starting a new industry in a way that includes communities left behind for far too long. Members of those communities will have the opportunity to apply for licenses to open a dispensary, become a craft grower or infuser, or transport product under the new law. Illinois is the only state in the country to take an equity-centric approach to the legalization of cannabis and I thank all those who worked hard to make the launch a success,” said Hutchinson.

Considering where the Massachusetts market is currently and the kinds of opportunities and deal flow available to private placement investing, as savvy investors seek to enter vetted opportunities for deal flow in the legal market – including the rise of sale-leaseback deals locally as well as nationally – the time is now to start talking with those at the forefront of the industry to learn about private placement opportunities that aren’t coming down the road or tomorrow. They’re here. Right now.

***

If you’re an accredited investor looking for private placement investing opportunities in the legal cannabis space, visit www.cannpreneurpartners.com or email us today at invest@cannapreneurpartners.com to learn how you or your investing group and investor syndicates can access a stream of vetted cannabis investment opportunities from retail and cultivation, to tech, ancillary services, debt lending, real estate, and other deal flow opportunities through Cannapreneur Partners.

CURIOUS ABOUT HOW CANNAPRENEUR PARTNERS LEVERAGES PRIVATE CAPITAL INVESTMENT IN THE LEGAL CANNABIS MARKET?

WATCH THIS 2-MINUTE VIDEO